There are no set rules in life. Your small business insurance cancellation letter is one of them. You may need to stop it at some point. If you have to do that, make sure you follow your insurance company’s instructions and send a letter canceling your coverage.

When is it time to quit your business insurance?

It’s never a good idea to cancel a small business insurance coverage, especially in today’s dangerous business world. Before you cancel an insurance, you should pronto insurance make sure that neither your business nor your personal funds are at risk. If you want to change your insurance with something better, cheaper, or more fitting, do some study ahead of time and get quotes from more than one company.

Here are some reasons you might want to cancel your insurance policy:

- You think the insurance costs are too high.

- You need new security because your business has changed.

- You’re leaving the state, and your current insurance company doesn’t cover you there.

- You’re not happy with the service your insurance company gives you.

- You want to group several different policies into one cheaper policy.

- Think about the risks of stopping your insurance.

- If you decide to cancel your policy, here are four things you should think about for your business:

Are you willing to put your company at risk of lawsuits or other costly claims?

If you cancel your fred loya insurance before getting a new one, you won’t have any protection against lawsuits or other costly things that could happen.

Will you leave a coverage gap when you end an insurance policy that has already paid out claims?

When you make a claim, your american national insurance will cover things that happened in the past. However, you must have ongoing coverage, even if you switch companies. This type of policy is common with directors and officers, professional liability, and mistakes and omissions insurance qatar insurance company shariah compliance. To get coverage for an insured event that happened in the past, you need to have current hugo insurance. If you decide to cancel your policy, you can buy an extra extended reporting period (ERP) or “tail coverage” from your insurance company. In this case, you can still file for benefits even though you cancelled your claims-made insurance.

Will you save money by making your insurance cancellation letter?

It’s important to save money on insurance. But if it means leaving your business vulnerable, it might not be the best choice in the long run.

Will changing your benefits better cool insuring arena meet your wants than getting rid of your policy? You might be able to change your benefits to fit your needs without having to quit your insurance. For instance, if the type of your business has changed or if you’ve moved, you might be able to change your coverage to fit your new needs.

Do you still want to cancel? Send a written letter to stop your insurance.

You should send a written cancellation notice if you have a good reason to do so and it won’t put your business at further risk harley davidson insurance. You should check your policy first to see if there are any canceling rules before you do that, though. For instance, your insurance company might need your letter to go to a certain department or need a certain number of days’ notice before it can end your coverage.

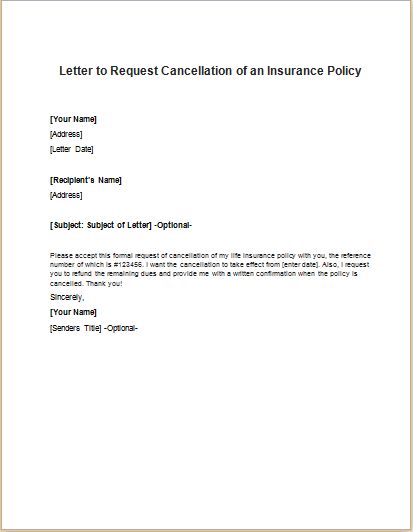

Once you know what needs to be done, it’s time to write your notice to stop your insurance. In your letter, you should:

- Notice date insurance cancellation letter

- The name and location of the insurance company insurance cancellation letter

- The right department name and person to call insurance cancellation letter

- The name of the insured person can be found on the policy’s disclosures page.

- The insured’s postal address insurance cancellation letter

- Phone number of the insured insurance cancellation letter

- Number of policy insurance cancellation letter

- Coverage length (on the page of statements)

Next, write the letter’s body. This should be in the body:

- When you’d like to cancel your policy

- A request for a return of fees that were not used

- A note telling the insurance company that you no longer give them permission to take money out of your account to pay your bills

- A signed request for proof from the insurance company that they will carry out your request by the date you want